It's been awhile since we've looked at the markets and for good reason...not much has changed since the last time we looked at them.

Oh yes, the prices have moved drastically, but the profit relationships haven't changed all that much, especially on backgrounded calves. If you have ranch calves that you didn't sell in NOV and decided to put a few extra pounds on to sell after the first of the year, you scored, BIG TIME.

Good for you, but don't get greedy. Most of these calves probably have little if any price protection on them so take the profit while you can get it. The prices on feeders that we are seeing in the cash and futures market now could fall just as fast as they've climbed.

I'm not really sure why we are seeing the price levels we are seeing in the feeder market right now considering that I see little profit in the fat market, even at $112.00 on the APR 11 and $109.00 on the JUN 11.

5 wt. steers bought today to be sold on the JUN 11 are looking at breakeven to losses of $50+ on the cash and maybe +$20-$30 or so on the grid, maybe a little more if they are Verified. Heifers look breakeven to +$50 or so on the cash and +$50 and better on the grid.

So, not peanuts by any means, but not outlandish either.

But no mind...we don't make the rules, we just find the inefficiencies and capitalize on them.

Here is what I see in the backgroundign world right now...

Steers, medium 1, 565# @ $141.91

This is ridiculous, these are money losers you probably don't want right now unless you are going to finish them out.

Steers, medium 1, 666# @ $126.80

DOF 120

ADG 2#/day

COG $0.65/lb

APR 11 $124.97

Breakeven: $110.00

Profit: $78.38/hd less basis and commissions

Steers, medium 1, 783# @ $122.14 (notice the $15.11 spread between 5 and 6 and the $4.66 spread between 6 and 7).

DOF 120

ADG 2#/day

COG $0.65

Breakeven: $109.00

Profit: $112.30/hd less basis and commissions

That's better but the girls are still the better buy for the money...

Heifers, medium 1, 562# @ $125.95

DOF 120

ADG 2#/day

COG $0.65

Breakeven: $108.00

Profit: $85.45/hd less basis and commissions

Heifers, medium 1, 677# @ $117.00

DOF 120

ADG 2#/day

COG $0.65

Breakeven: $103.00

Profit: $144.49/hd less basis and commissions

Heifers, medium 1, 787# @ $110.33

DOF 120

ADG 2#/day

COG $0.65

Breakeven: $99.00

Profit: $196.58/hd less basis and commissions

So there you have it, that is about what we have seen all summer and fall and not much has changed really.

One thing to be very careful of however, is basis. As the futures market gets higher, basis tends to get wider. Right now we are seeing basis of $3.50 - $5.00/cwt. depending on where you are at. So when you see the big profits coming in on some of these cattle, it is not quite as rosy as it may seem because the basis has widened considerably compared to this summer and fall and it may widen more as we go along.

Basis is a very hard thinng to predict or even make an educated guess at. Just be aware that basis is having a much greater impact right now than it normally does and the magnitude of the impact depends somewhat on where youa re.

Thank you and have a great day!

The South Dakota Rancher Newsletter is a subsidiary of Cow Camp Publishing. Copyright 2005-2013. All rights reserved.

Thursday, December 30, 2010

Monday, December 27, 2010

The New Year

First of all, I must apologize for disappearing for about a month and a half. The end of November and all of December have been out of control in terms of being busy with the end of the academic semester, a larger than normal demand for speaking engagements, the holiday season, and preparing for the annual voyage to South America.

That being said, we have a lot to catch up on, namely, the trip to Argentina that casts off next week. A little bit of background on this trip: the trip is a study-tour of South American agriculture and is offered to undergraduate and graduate students at SDSU. The main objectives are to engage our South American counterparts in discussions about the development or more correctly, the re-development of agriculture in the lower half of the continent.

A brief history: around the late-1800's and early 1900's, lower South America, mostly Argentina had one of the most robust agricultural economies in the world which, summarily collapsed following WWII. It has only been since the middle 1980's that these countries have seen a resurgence in agricultural development. Flip forward to 2007 and following the collapse of the AR Peso in 2002, Argentina's ag economy is beginning to take off again and SDSU decides that a study tour of the region should be organized.

So, this 5th group of students that are travelling to Argentina next week with me will get exposure to the advantages and disadvantages of globalized agriculture. Now I am sure you are thinking, why not Brazil? Well, we have gone to Brazil, Chile, Uruaguay, and Paraguay in the past but for logistical reasons, I have focused more on Argentina in the past couple of years. Furthermore, I try to mix it up a bit just to add some variety to the trip. Brazil is an incredible place to visit, but getting 20 visas at the 11th hour has not done much for the color or the amount of hair I have on my head. But Brazil will certainly be on the table for the 2012 trip.

In any event, we will be in Argentina and Uruguay for the next couple of weeks and my hope is to keep you all updated on our progress and let you know a little bit about what we have been touring. Hopefully this will dovetail into the visit I got from the CREA group in August. And yes, we will be visiting a lot of the folks that came to South Dakota.

Thank you and Have a Great Day!!

That being said, we have a lot to catch up on, namely, the trip to Argentina that casts off next week. A little bit of background on this trip: the trip is a study-tour of South American agriculture and is offered to undergraduate and graduate students at SDSU. The main objectives are to engage our South American counterparts in discussions about the development or more correctly, the re-development of agriculture in the lower half of the continent.

A brief history: around the late-1800's and early 1900's, lower South America, mostly Argentina had one of the most robust agricultural economies in the world which, summarily collapsed following WWII. It has only been since the middle 1980's that these countries have seen a resurgence in agricultural development. Flip forward to 2007 and following the collapse of the AR Peso in 2002, Argentina's ag economy is beginning to take off again and SDSU decides that a study tour of the region should be organized.

So, this 5th group of students that are travelling to Argentina next week with me will get exposure to the advantages and disadvantages of globalized agriculture. Now I am sure you are thinking, why not Brazil? Well, we have gone to Brazil, Chile, Uruaguay, and Paraguay in the past but for logistical reasons, I have focused more on Argentina in the past couple of years. Furthermore, I try to mix it up a bit just to add some variety to the trip. Brazil is an incredible place to visit, but getting 20 visas at the 11th hour has not done much for the color or the amount of hair I have on my head. But Brazil will certainly be on the table for the 2012 trip.

In any event, we will be in Argentina and Uruguay for the next couple of weeks and my hope is to keep you all updated on our progress and let you know a little bit about what we have been touring. Hopefully this will dovetail into the visit I got from the CREA group in August. And yes, we will be visiting a lot of the folks that came to South Dakota.

Thank you and Have a Great Day!!

Monday, November 15, 2010

This Week In Cattle

Some strength in the futures on feeder cattle this last week has really opened up opportunities for short turns on light calves that we haven't seen in the last couple of weeks. We can talk corn futures and feedlot placements until we are blue in the face, it doesn't really matter.

The only thing that really matters is that the spreads between the cash market on lighter calves and the futures on the MAR 11 are such that there are some pretty impressive profits to be made.

Examples:

Buy steers, medium 1, 530# @ $129.53

Short hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.75/lb. @ 2.5lbs/day

Weight out: 830#

Breakeven: $109.82

Profit: $40.92/head less basis and commissions

Buy steers, medium 1, 573# @ $127.30

Short hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.75/lb. @ 2.5 lbs./day

Weight out: 873#

Breakeven: $109.32

Profit: $47.33/head less basis and commissions

Buy steers, medium 1, 614# @ $123.69

Short hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.75/lb. @ 2.5 lbs. day

Weight out: 914#

Breakeven: $107.70

Profit: $64.35/head less basis and commissions

The profit potential on short turns of heifers looks great, as it has all summer. Heifers are still way undervalued in the market.

Buy heifers, 522# @ $120.41

Short hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.75/lb. @ 2.5 lbs./day

Weight out: 822#

Breakeven: $103.83

Profit: $89.70/head less basis and commissions

Buy heifers, 571# @ $116.76

Short hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.75/lb. @ 2.5 lbs./day

Weight out: 871#

Breakeven: $102.37

Profit: $107.77/head less basis and commissions

Buy heifers, 611# @ $119.50

Short hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.75/lb. @ 2.5 lbs. day

Weight out: 911#

Breakeven: $104.84

Profit: $90.22/head less basis and commissions

On these heifers, I think there are also some opportunities to run a 60 day turn on the JAN 11 and another short run on the MAR 11. It's hard to tell at this point where we will be at 60 days from MAR, but I think we will be in as good of a position or better than where we are at today.

We will see....

The other thing to watch is COG, this week I bumped COG to $0.75/lb. rather than $0.65/lb. I have been using. It should be no problem for most guys to squeeze a measley 2.5lbs./day out of a 500# calf for $0.65/lb. However, the cost of everything is up a little in the last month or so, so when I model my cost of gains, it is creeping towards the $0.75 level, so that's what I used.

I have received many questions about why 2.5 lbs. day, the simple answer is that when I do the price/performance thresholds on cost of gain, it breaks at about 2.5lbs./day at $0.75/lb.

If I go to 3lbs/day of performance, my COG is going to rise to $0.92 lb. in my COG model, mostly because I am going to need more corn to maintain that level of performance and I'll have more weight to haul at the end. The $0.92/lb. is assuming $3.65/bu. corn, which is what my data shows the average guy can grow it for. If you are buying corn, forget it, it's not going to work unless you had a long hedge on corn earlier this summer.

Same set of 530# steers at 3 lbs./day performance and a $0.92 COG

Buy 530# steers @ $129.53

Hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.92 @ 3 lbs./day

Weight out: 890#

Breakeven: $115.15

Loss: -$3.63/head less basis and commissions.

Not every weight class is going to be a money loser of course, but the point is that overall the market isn't willing to pay for the additional corn...at least not yet.

Keep the rations simple and cheap.

Thank You and Have a Great Day!!

The only thing that really matters is that the spreads between the cash market on lighter calves and the futures on the MAR 11 are such that there are some pretty impressive profits to be made.

Examples:

Buy steers, medium 1, 530# @ $129.53

Short hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.75/lb. @ 2.5lbs/day

Weight out: 830#

Breakeven: $109.82

Profit: $40.92/head less basis and commissions

Buy steers, medium 1, 573# @ $127.30

Short hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.75/lb. @ 2.5 lbs./day

Weight out: 873#

Breakeven: $109.32

Profit: $47.33/head less basis and commissions

Buy steers, medium 1, 614# @ $123.69

Short hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.75/lb. @ 2.5 lbs. day

Weight out: 914#

Breakeven: $107.70

Profit: $64.35/head less basis and commissions

The profit potential on short turns of heifers looks great, as it has all summer. Heifers are still way undervalued in the market.

Buy heifers, 522# @ $120.41

Short hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.75/lb. @ 2.5 lbs./day

Weight out: 822#

Breakeven: $103.83

Profit: $89.70/head less basis and commissions

Buy heifers, 571# @ $116.76

Short hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.75/lb. @ 2.5 lbs./day

Weight out: 871#

Breakeven: $102.37

Profit: $107.77/head less basis and commissions

Buy heifers, 611# @ $119.50

Short hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.75/lb. @ 2.5 lbs. day

Weight out: 911#

Breakeven: $104.84

Profit: $90.22/head less basis and commissions

On these heifers, I think there are also some opportunities to run a 60 day turn on the JAN 11 and another short run on the MAR 11. It's hard to tell at this point where we will be at 60 days from MAR, but I think we will be in as good of a position or better than where we are at today.

We will see....

The other thing to watch is COG, this week I bumped COG to $0.75/lb. rather than $0.65/lb. I have been using. It should be no problem for most guys to squeeze a measley 2.5lbs./day out of a 500# calf for $0.65/lb. However, the cost of everything is up a little in the last month or so, so when I model my cost of gains, it is creeping towards the $0.75 level, so that's what I used.

I have received many questions about why 2.5 lbs. day, the simple answer is that when I do the price/performance thresholds on cost of gain, it breaks at about 2.5lbs./day at $0.75/lb.

If I go to 3lbs/day of performance, my COG is going to rise to $0.92 lb. in my COG model, mostly because I am going to need more corn to maintain that level of performance and I'll have more weight to haul at the end. The $0.92/lb. is assuming $3.65/bu. corn, which is what my data shows the average guy can grow it for. If you are buying corn, forget it, it's not going to work unless you had a long hedge on corn earlier this summer.

Same set of 530# steers at 3 lbs./day performance and a $0.92 COG

Buy 530# steers @ $129.53

Hedge MAR 11 @ $114.75

Feed for 120 days

COG $0.92 @ 3 lbs./day

Weight out: 890#

Breakeven: $115.15

Loss: -$3.63/head less basis and commissions.

Not every weight class is going to be a money loser of course, but the point is that overall the market isn't willing to pay for the additional corn...at least not yet.

Keep the rations simple and cheap.

Thank You and Have a Great Day!!

Wednesday, November 10, 2010

Economics of Protein Supplementation

One of the principal costs associated with wintering cows is protein supplementation. Winter range, harvested forages, and crop residues for the most part, contain plenty of energy to meet the needs of gestating cows during the winter.

The protein content of these energy sources however, tends to be fairly low which will ultimately reduce intake and digestibility of these types of forages.

The feed products typically used to supplement ruminant livestock can be broken down into two major categories:

1) natural vs. non-natural protein sources

2) Low labor vs. high labor delivery methods

These two classifications cover the majority of feed supplements on the market and largely determine how they are priced.

Natural proteins consist of things like alfalfa, oil seed meals (soybean, cottonseed, sunflower), corn by-product distillers grains, and the like. Non-natural protein are largely formulated to include urea.

Typically, natural proteins used in supplementing beef cows are more efficient and usually lower cost than urea-based supplements. However, natural protein source typically require more labor and equipment to deliver than urea-based products.

In essence, you are paying for the convenience factor with certain types of protein supplements.

The other thing you have to watch out for with protein supplements is sticker shock. Some supplements can seem very expensive on a per ton basis, but actually are relatively cheap on a per pound of crude protein (CP) basis because you don't have to feed very much of the bulk material to meet dietary requirements.

Therefore, it is essential that a manager knows how to calculate the cost of protein on a per pound basis so you can assess the convenience factor.

Example:

To calculate cost per pound of crude protein for a feed supplement use the following formulas:

A) Conversion from one ton of bulk product to pounds of protein in that ton

Pounds of CP in bulk product = 2000lbs. x % crude protein

If we take soybean meal (SBM) as an example, SBM contains about 46% CP and costs about $300 per ton on average over the last year-and-a-half or so.

2000 lbs. of SBM x .46 (% CP) = 920 lbs. of protein

B) Then we convert cost per ton to cost per pound of CP by dividing cost per ton by pounds of CP:

$300 per ton = $0.32 per lb. of protein

920 lbs. of protein

That's it!! You can make this calculation with any type of protein supplement.

Now you can compare the cost of different supplements based on a common denominator so you are comparing apples to apples.

Of course, prices change frequently on a per ton basis, which is going to change cost per pound of CP, so a person needs to recalculate these everytime they go to buy bulk product.

When you calculate the cost per pound of CP for a variety of supplements, then you have to assess how much you are willing to pay for convenience.

As an example, alfalfa is a tremendously cheap source of protein for livestock on a per pound of CP basis, however, after you figure in the cost of delivering the product to livestock, it may or may not look all that cheap anymore. On the other hand, lick tubs are really easy to deliver, but does the convenience justify the cost? You have to decide.

Table 1 shows the cost comparison of common protein supplements on a cost of CP basis using average per ton prices.

Product Cost per lb. of CP

Corn by-product distillers grains $0.25

Alfalfa $0.30

Soybean meal $0.32

Cottonseed meal $0.27

Sunflower meal $0.44

Commercial range cake $0.68

Lick Tubs $1.87

Now, you make the call on what works for you and what doesn't.

Thank You and Have a Great Day!!

The protein content of these energy sources however, tends to be fairly low which will ultimately reduce intake and digestibility of these types of forages.

The feed products typically used to supplement ruminant livestock can be broken down into two major categories:

1) natural vs. non-natural protein sources

2) Low labor vs. high labor delivery methods

These two classifications cover the majority of feed supplements on the market and largely determine how they are priced.

Natural proteins consist of things like alfalfa, oil seed meals (soybean, cottonseed, sunflower), corn by-product distillers grains, and the like. Non-natural protein are largely formulated to include urea.

Typically, natural proteins used in supplementing beef cows are more efficient and usually lower cost than urea-based supplements. However, natural protein source typically require more labor and equipment to deliver than urea-based products.

In essence, you are paying for the convenience factor with certain types of protein supplements.

The other thing you have to watch out for with protein supplements is sticker shock. Some supplements can seem very expensive on a per ton basis, but actually are relatively cheap on a per pound of crude protein (CP) basis because you don't have to feed very much of the bulk material to meet dietary requirements.

Therefore, it is essential that a manager knows how to calculate the cost of protein on a per pound basis so you can assess the convenience factor.

Example:

To calculate cost per pound of crude protein for a feed supplement use the following formulas:

A) Conversion from one ton of bulk product to pounds of protein in that ton

Pounds of CP in bulk product = 2000lbs. x % crude protein

If we take soybean meal (SBM) as an example, SBM contains about 46% CP and costs about $300 per ton on average over the last year-and-a-half or so.

2000 lbs. of SBM x .46 (% CP) = 920 lbs. of protein

B) Then we convert cost per ton to cost per pound of CP by dividing cost per ton by pounds of CP:

$300 per ton = $0.32 per lb. of protein

920 lbs. of protein

That's it!! You can make this calculation with any type of protein supplement.

Now you can compare the cost of different supplements based on a common denominator so you are comparing apples to apples.

Of course, prices change frequently on a per ton basis, which is going to change cost per pound of CP, so a person needs to recalculate these everytime they go to buy bulk product.

When you calculate the cost per pound of CP for a variety of supplements, then you have to assess how much you are willing to pay for convenience.

As an example, alfalfa is a tremendously cheap source of protein for livestock on a per pound of CP basis, however, after you figure in the cost of delivering the product to livestock, it may or may not look all that cheap anymore. On the other hand, lick tubs are really easy to deliver, but does the convenience justify the cost? You have to decide.

Table 1 shows the cost comparison of common protein supplements on a cost of CP basis using average per ton prices.

Product Cost per lb. of CP

Corn by-product distillers grains $0.25

Alfalfa $0.30

Soybean meal $0.32

Cottonseed meal $0.27

Sunflower meal $0.44

Commercial range cake $0.68

Lick Tubs $1.87

Now, you make the call on what works for you and what doesn't.

Thank You and Have a Great Day!!

Monday, November 1, 2010

This Week In Cattle

There is a lot of feed in the country this year with record levels of precipitation and pretty good growing conditions throughout the summer. With abundant feed and really decent cattle prices, I have received a lot inquiries from ranchers about bringing in calves to feed on a short turnaround to burn some extra feed and make a little cash on the side.

It's a pretty good idea, although getting them bought right is going to be a pretty tall order right now. The cash market is still pretty hot and it doesn't look like it is going to cool off anytime soon. Furthermore, the feeder futures are taking a beating from the big gains corn has made in the past month or so.

Over the short-term, I think there is some money to be made in some short turnarounds on some lightweight feeder calves. The big thing right now is to stay away from the real lightweight steers. High 4 wts. are running nearly $140.00 and I just can't make that pencil for most situations. Even mid-5 wts. are a little nip-and-tuck, so a person is really going to have to get them bought right to make them work. I think 6 wt steers and most classes of heifers are going to work pretty well.

A really good option for some guys wil be to find some mid-weight 7-8's. There aren't a lot of them around as most of them were placed in September and October, but there are a few stragglers out there if you can find them.

Buy steers, medium 1, 566# @ $128.00

Protect JAN 11 @ $110.80

Feed for 75 days

COG: $0.65 @ 2.5#/day

Weight out: 753#

Breakeven: $113.02

Loss: -$16.74/head less basis and commissions

Buy steers, medium 1, 606# @ $122.40

Protect JAN 11 @ $110.80

Feed for 75 days

COG: $0.65 @ 2.5#/day

Weight out: 793#

Breakeven: $1.08.83

Profit: $15.57/head less basis and commissions

Like I said, it's nip-and-tuck on the steers, getting them bought right is going to be the difference.

Heifers look a little better:

Buy heifers, medium 1, 558# @ $118.51

Protect JAN 11 @ $110.80

Feed for 75 days

COG: $0.65 @ 2.5#/day

Weight out: 745#

Breakeven: $105.05

Profit: $42.85/head less basis and commissions

Buy heifers, medium 1, 631# @ $112.00

Protect JAN 11 @ $110.80

Feed for 75 days

COG: $0.65 @ 2.5#/day

Weight out: 818#

Breakeven: $101.12

Profit: $78.30/head less basis and commissions

The alternative is to try to snag some heavier cattle that will look like this:

Buy heifers, medium 1, 753# @ $107.21

Protect JAN 11 @ $110.80

Feed for 75 days

COG: $0.75 @ 2.5#/day

Weight out: 940#

Breakeven: $100.78

Profit: $94.15/head less basis and commissions

These cattle are going to have a little higher cost of gain to get the performance out of them but you can see that pencil pretty nicely...if you can find them in large enough quantities to make them work.

The other thing to watch for is to hang on to some of these light to mid-weights for a little longer and cash in on the price slide:

Buy steers, medium 1, 566# @ $128.00

Protect MAR 11 @ $111.60

Feed for 150 days

COG: $0.65 @ 2.5#/day

Weight out: 941#

Breakeven: $103.45

Profit: $76.66/head less basis and commissions

So on that same set of 566# steers, we improved from a $16/head loss to a $76.66/head profit, just by hanging on to them a little longer. By using moderate performance goals at a pretty reasonable COG, we can catch the price slide advantage on the MAR 11.

Heifers look even better:

Buy heifers, medium 1, 558# @ $118.51

Protect MAR 11 @ $111.60

Feed for 150 days

COG: $0.65 @ 2.5#/day

Weight out: 933#

Breakeven: $97.00

Profit: $136.19/head less basis and commissions

So we jumped these heifers from a $42.85/head profit to a $136.19/head profit by holding down performance, keeping COG reasonable and catching the MAR 11.

If this strategy looks good, you might consider an LRP or option put rather than a short hedge so you can protect your bottom side and let the top side ride. It will probably save you a lot of margin calls we get closer to MAR.

Thank You and Have a Great Day!!

It's a pretty good idea, although getting them bought right is going to be a pretty tall order right now. The cash market is still pretty hot and it doesn't look like it is going to cool off anytime soon. Furthermore, the feeder futures are taking a beating from the big gains corn has made in the past month or so.

Over the short-term, I think there is some money to be made in some short turnarounds on some lightweight feeder calves. The big thing right now is to stay away from the real lightweight steers. High 4 wts. are running nearly $140.00 and I just can't make that pencil for most situations. Even mid-5 wts. are a little nip-and-tuck, so a person is really going to have to get them bought right to make them work. I think 6 wt steers and most classes of heifers are going to work pretty well.

A really good option for some guys wil be to find some mid-weight 7-8's. There aren't a lot of them around as most of them were placed in September and October, but there are a few stragglers out there if you can find them.

Buy steers, medium 1, 566# @ $128.00

Protect JAN 11 @ $110.80

Feed for 75 days

COG: $0.65 @ 2.5#/day

Weight out: 753#

Breakeven: $113.02

Loss: -$16.74/head less basis and commissions

Buy steers, medium 1, 606# @ $122.40

Protect JAN 11 @ $110.80

Feed for 75 days

COG: $0.65 @ 2.5#/day

Weight out: 793#

Breakeven: $1.08.83

Profit: $15.57/head less basis and commissions

Like I said, it's nip-and-tuck on the steers, getting them bought right is going to be the difference.

Heifers look a little better:

Buy heifers, medium 1, 558# @ $118.51

Protect JAN 11 @ $110.80

Feed for 75 days

COG: $0.65 @ 2.5#/day

Weight out: 745#

Breakeven: $105.05

Profit: $42.85/head less basis and commissions

Buy heifers, medium 1, 631# @ $112.00

Protect JAN 11 @ $110.80

Feed for 75 days

COG: $0.65 @ 2.5#/day

Weight out: 818#

Breakeven: $101.12

Profit: $78.30/head less basis and commissions

The alternative is to try to snag some heavier cattle that will look like this:

Buy heifers, medium 1, 753# @ $107.21

Protect JAN 11 @ $110.80

Feed for 75 days

COG: $0.75 @ 2.5#/day

Weight out: 940#

Breakeven: $100.78

Profit: $94.15/head less basis and commissions

These cattle are going to have a little higher cost of gain to get the performance out of them but you can see that pencil pretty nicely...if you can find them in large enough quantities to make them work.

The other thing to watch for is to hang on to some of these light to mid-weights for a little longer and cash in on the price slide:

Buy steers, medium 1, 566# @ $128.00

Protect MAR 11 @ $111.60

Feed for 150 days

COG: $0.65 @ 2.5#/day

Weight out: 941#

Breakeven: $103.45

Profit: $76.66/head less basis and commissions

So on that same set of 566# steers, we improved from a $16/head loss to a $76.66/head profit, just by hanging on to them a little longer. By using moderate performance goals at a pretty reasonable COG, we can catch the price slide advantage on the MAR 11.

Heifers look even better:

Buy heifers, medium 1, 558# @ $118.51

Protect MAR 11 @ $111.60

Feed for 150 days

COG: $0.65 @ 2.5#/day

Weight out: 933#

Breakeven: $97.00

Profit: $136.19/head less basis and commissions

So we jumped these heifers from a $42.85/head profit to a $136.19/head profit by holding down performance, keeping COG reasonable and catching the MAR 11.

If this strategy looks good, you might consider an LRP or option put rather than a short hedge so you can protect your bottom side and let the top side ride. It will probably save you a lot of margin calls we get closer to MAR.

Thank You and Have a Great Day!!

Monday, October 4, 2010

This Week In Cattle

The cash market is heating up with the fall run of calves starting to filter into the marketplace. Although the cash market has remained pretty strong, especially on the lightweights, the fall calf run is putting a lot of pressure on the futures market. this is going to create some opportunities for guys that want to add some weight to these calves before they go to town. However, the key thing in this market will be to look at how much feed is the market willing to pay for?

We had a discussion earlier this summer about the disparity between feed value and market value of that feed converted to liveweight. I think that discussion needs to be monitored in this market right now. Let's look at some examples of backgrounding scenarios in this market:

Wean 474# steers; today's value $130.51 = gross return of $618.61/head

$618.61/head - $500 cost per calf = net return of $118.61/head

Now let's feed those steers for 90 days, 2.5#/day of gain @ $0.65/lb of gain

We'll protect them on the JAN 11 @ $112.10

Sale weight 699#

Breakeven $92.80/head

Profit $134.88/head less basis and commissions

Difference between selling off the cow and backgrounding $16.27/head

On these lighter steers, we gained a little by hanging on to them and feeding them.

Now let's back that ration off a bit and look at lower performance and cost of gain

Feed those steers for 90 days, 1.5#/day of gain @ $0.35/lb of gain

We'll protect them on the JAN 11 @ $112.10

Sale weight 609#

Breakeven $90.26/head

Profit $132.99/head less basis and commissions

Difference between selling off the cow and backgrounding $14.38/head

Difference between backgrounding on higher performance and lower performance rations $1.89/head

So we didn't gain a heck of a lot on these lighter steers by adjusting performance and cost of gain

Now let's look at some heavier steers

Wean 575# steers; today's value $126.24 = gross return of $725.88/head

$725.88/head - $500 cost per calf = net return of $225.88/head

Now let's feed those steers for 90 days, 2.5#/day of gain @ $0.65/lb of gain

We'll protect them on the JAN 11 @ $112.10

Sale weight 800#

Breakeven $80.81/head

Profit $250.30/head less basis and commissions

Difference between selling off the cow and backgrounding $24.42/head

On these heavier steers, we gained almost $25/head by hanging on to them and feeding them.

Now let's back that ration off a bit and look at lower performance and cost of gain

Feed those steers for 90 days, 1.5#/day of gain @ $0.35/lb of gain

We'll protect them on the JAN 11 @ $112.10

Sale weight 710#

Breakeven $77.11/head

Profit $248.41/head less basis and commissions

Difference between selling off the cow and backgrounding $22.53/head

Difference between backgrounding on higher performance and lower performance rations $1.89/head

So you can see that right now the market is paying for the feed either way for steers however, the game gets a little more interesting when you look at heifers.

Wean 479# heifers; today's value $115.95 = gross return of $555.40/head

$555.40/head - $500 cost per calf = net return of $55.40/head

Now let's feed those heifers for 90 days, 2.5#/day of gain @ $0.65/lb of gain

We'll protect them on the JAN 11 @ $112.10

Sale weight 789#

Breakeven $92.21/head

Profit $139.98/head less basis and commissions

Difference between selling off the cow and backgrounding $84.58/head

On these lighter heifers, we gained quite a bit by hanging on to them and feeding them. Partially because of feed value and partially because of the price slide we gained by protecting them on the board.

There isn't much difference in net profit right now by feeding them to lower performance and cost of gain. Either way will net about the same.

Let's look at some heavier heifers:

Wean 567# heifers; today's value $112.54 = gross return of $638.10/head

$638.10/head - $500 cost per calf = net return of $138.10/head

Now let's feed those heifers for 90 days, 2.5#/day of gain @ $0.65/lb of gain

We'll protect them on the JAN 11 @ $112.10

Sale weight 792#

Breakeven $82.18/head

Profit $236.95/head less basis and commissions

Difference between selling off the cow and backgrounding $98.85/head

This is why I think there will be some good opportunities for backgrounders this fall, especially in the heifers. These of course are just examples and values are going to change over time, but most folks are still a month or so out from weaning calves so there is some time to watch what the markets are doing and respond accordingly.

Thank You and Have a Great Day!!

We had a discussion earlier this summer about the disparity between feed value and market value of that feed converted to liveweight. I think that discussion needs to be monitored in this market right now. Let's look at some examples of backgrounding scenarios in this market:

Wean 474# steers; today's value $130.51 = gross return of $618.61/head

$618.61/head - $500 cost per calf = net return of $118.61/head

Now let's feed those steers for 90 days, 2.5#/day of gain @ $0.65/lb of gain

We'll protect them on the JAN 11 @ $112.10

Sale weight 699#

Breakeven $92.80/head

Profit $134.88/head less basis and commissions

Difference between selling off the cow and backgrounding $16.27/head

On these lighter steers, we gained a little by hanging on to them and feeding them.

Now let's back that ration off a bit and look at lower performance and cost of gain

Feed those steers for 90 days, 1.5#/day of gain @ $0.35/lb of gain

We'll protect them on the JAN 11 @ $112.10

Sale weight 609#

Breakeven $90.26/head

Profit $132.99/head less basis and commissions

Difference between selling off the cow and backgrounding $14.38/head

Difference between backgrounding on higher performance and lower performance rations $1.89/head

So we didn't gain a heck of a lot on these lighter steers by adjusting performance and cost of gain

Now let's look at some heavier steers

Wean 575# steers; today's value $126.24 = gross return of $725.88/head

$725.88/head - $500 cost per calf = net return of $225.88/head

Now let's feed those steers for 90 days, 2.5#/day of gain @ $0.65/lb of gain

We'll protect them on the JAN 11 @ $112.10

Sale weight 800#

Breakeven $80.81/head

Profit $250.30/head less basis and commissions

Difference between selling off the cow and backgrounding $24.42/head

On these heavier steers, we gained almost $25/head by hanging on to them and feeding them.

Now let's back that ration off a bit and look at lower performance and cost of gain

Feed those steers for 90 days, 1.5#/day of gain @ $0.35/lb of gain

We'll protect them on the JAN 11 @ $112.10

Sale weight 710#

Breakeven $77.11/head

Profit $248.41/head less basis and commissions

Difference between selling off the cow and backgrounding $22.53/head

Difference between backgrounding on higher performance and lower performance rations $1.89/head

So you can see that right now the market is paying for the feed either way for steers however, the game gets a little more interesting when you look at heifers.

Wean 479# heifers; today's value $115.95 = gross return of $555.40/head

$555.40/head - $500 cost per calf = net return of $55.40/head

Now let's feed those heifers for 90 days, 2.5#/day of gain @ $0.65/lb of gain

We'll protect them on the JAN 11 @ $112.10

Sale weight 789#

Breakeven $92.21/head

Profit $139.98/head less basis and commissions

Difference between selling off the cow and backgrounding $84.58/head

On these lighter heifers, we gained quite a bit by hanging on to them and feeding them. Partially because of feed value and partially because of the price slide we gained by protecting them on the board.

There isn't much difference in net profit right now by feeding them to lower performance and cost of gain. Either way will net about the same.

Let's look at some heavier heifers:

Wean 567# heifers; today's value $112.54 = gross return of $638.10/head

$638.10/head - $500 cost per calf = net return of $138.10/head

Now let's feed those heifers for 90 days, 2.5#/day of gain @ $0.65/lb of gain

We'll protect them on the JAN 11 @ $112.10

Sale weight 792#

Breakeven $82.18/head

Profit $236.95/head less basis and commissions

Difference between selling off the cow and backgrounding $98.85/head

This is why I think there will be some good opportunities for backgrounders this fall, especially in the heifers. These of course are just examples and values are going to change over time, but most folks are still a month or so out from weaning calves so there is some time to watch what the markets are doing and respond accordingly.

Thank You and Have a Great Day!!

Tuesday, September 28, 2010

Cull Cows Today

Building upon the earlier discussion, it might be useful for guys to update their analysis of cull cow calue as they get closer to making marketing decisions.

The same principles apply today as they did the first time I talked about this. Of course as we get closer to the fall calf run and subsequent glut of cull cows at salebarns across the land this fall, prices have dropped from earlier this summer and the thin/fleshy spread is beginning to tighten. Right now the spread is about $7.00/cwt., which is pretty good, but I expect it to tighten considerably into JAN before loosening a little in late-FEB and MAR.

So as guys think about how to add value to market culls, think about when the market will be most likely to pay for the feed they put into these culls. 60 days from weaning/preg check may not be the best spread to work with. 90 days will look a lot different.

If guys look at more of a MAR time-frame for marketing, they should back calculate rations and cost of gain to optimize value.

Example:

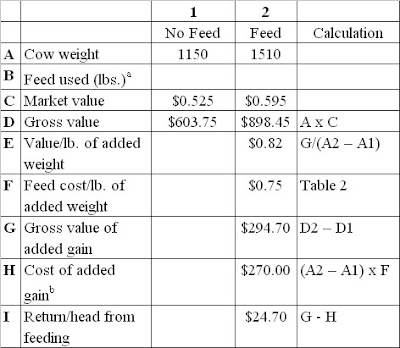

Our average cow at 1150# @ $52.50 yields $603.75/head.

Now let's say we take this 1150# cow and put her on feed for 60 days.

Now let's say we take this 1150# cow and put her on feed for 60 days.

She'll gain about 3 pounds/day with a cost fo gain of $0.75.

Now that we have put an extra 180 lbs. on her and she's weighing about 1330 lbs., in today's market she'll probably be valued somewhere around $59.50/cwt. So she will gross $791.35.

Using our Return on Feed Value Calculator we see that with a $0.75 cost of gain, she nets about $52.60 more than she would have if we didn't feed her.

So, if we go back to our original discussion on this topic, adding weight beyond the 180 lbs. is probably not economically feasible.

Here's why:

Once she has been fed to a fleshy appearance and she falls within the weight/value grid, any additional weight is paid for at the market place at the same price. Meaning, there is a price threshold where the market doesn't pay any additional value.

Example:

Same average cow at 1150# @ $52.50 yields $603.75/head.

Now let's say we take this cow and put her on feed for 120 days.

Now that we have put an extra 360 lbs. on her and she's weighing about 1510 lbs. she'll still be valued somewhere around $59.50/cwt.

So she will now gross $898.45/head.

Using the Return on Feed Value Calculator we see that with a $0.75 cost of gain, now she only nets about $24.70/head more than she would have if we didn't feed her.

So we lost about $27.90/head because we fed her more feed than what the market was willing to pay for.

So in effect our additional feed bill chewed up any margin made on the extra weight.

The other thing you have to watch out for is the spread between thin and fleshy. In our currrent market that is about to be flooded with culls, the spread is going to tighten considerably and probably won't begin to widen until until late-FEB or MAR.

In our example the spread was about $7.00/cwt. That is pretty typical for this time of year when supply is tight, but where we are now in the fall when supply increases, not only will the value drop but the spread will tighten. You will have to take this into consideration.

Let's look at the exact same example, but now the spread will shrink to $4.00/cwt.

Just by shrinking the spread between thin and fleshy, our additional profit over not feeding these cows shrank from $52.60/head to $12.70/head. Now feeding these cows is probably not worth the hassle.

So if you feed culls for 60 days and the spread is tight, back them off feed, put them on a maintenance ration, and wait for the spread to widen in late-FEB or MAR.

As a general rule, putting 180-220 lbs. on an average cow is probably going to most effectively optimize her value. You can adjust rate of gain with what you feed her so you have some market time flexibility built in to your system to take advantage of price point thresholds and thin/fleshy spreads.

Thank You and Have a Great Day!!

Monday, September 13, 2010

This Week In Cattle

As previously suggested, both the futures and the cash feeders market have soften significantly since the first of the month. Not really surprising since the fall run on weaned calves is getting close. However, the fat market has stayed fairly strong, although the basis is getting wider by the day.

Cash steers are running wildly out of control right now as they are lined up to take advantage of the $100+ fat futures, although I suspect the cash market will respond lower this week as a correction to the losses on the feeder board last week. Cash heifers are currently priced in the money and I expect that to get even a little better this week as cash steers make their correction. We will see soon enough.

A couple of quick observations:

My pencil isn't quite sharp enough to make steers pencil right now, even with the APR 11 at $102. If a person can deliver a really reasonable cost of gain (< $0.75), the heavy end might work, otherwise they might be well advised to hold off on cash steers and see how they react to a softer feeder market and the fall run on weaned calves.

Cash heifers are looking pretty good right now. Again, keeping cost of gain under control is going to be key, but even at $0.80, heifers will pencil pretty nicely on the APR 11.

Examples:

Buy steers, medium 1, 733# @ $124.45

APR 11 @ $102.10

COG @ $0.80

Weight out: 1350#

Breakeven: $104.13

Loss: <$27.46> /head less basis and commissions

Buy steers, medium 1, 961# @ $109.13

APR 11 @ $102.10

COG @ $0.80

Weight out: 1350#

Breakeven: $100.73

Profit: $18.41/head less basis and commissions

Buy heifers, medium 1, 728# @ $109.35

APR 11 @ $102.10

COG @ $0.80

Weight out: 1350#

Breakeven: $95.82

Profit: $84.68/head less basis and commissions

Buy heifers, medium 1, 965# @ $103.77

Apr 11 @ $102.10

COG @ $0.80

Weight out: 1350#

Breakeven: $96.69

Profit: $68.96/head less basis and commissions

Thank you and Have a Great Day!!

Cash steers are running wildly out of control right now as they are lined up to take advantage of the $100+ fat futures, although I suspect the cash market will respond lower this week as a correction to the losses on the feeder board last week. Cash heifers are currently priced in the money and I expect that to get even a little better this week as cash steers make their correction. We will see soon enough.

A couple of quick observations:

My pencil isn't quite sharp enough to make steers pencil right now, even with the APR 11 at $102. If a person can deliver a really reasonable cost of gain (< $0.75), the heavy end might work, otherwise they might be well advised to hold off on cash steers and see how they react to a softer feeder market and the fall run on weaned calves.

Cash heifers are looking pretty good right now. Again, keeping cost of gain under control is going to be key, but even at $0.80, heifers will pencil pretty nicely on the APR 11.

Examples:

Buy steers, medium 1, 733# @ $124.45

APR 11 @ $102.10

COG @ $0.80

Weight out: 1350#

Breakeven: $104.13

Loss: <$27.46> /head less basis and commissions

Buy steers, medium 1, 961# @ $109.13

APR 11 @ $102.10

COG @ $0.80

Weight out: 1350#

Breakeven: $100.73

Profit: $18.41/head less basis and commissions

Buy heifers, medium 1, 728# @ $109.35

APR 11 @ $102.10

COG @ $0.80

Weight out: 1350#

Breakeven: $95.82

Profit: $84.68/head less basis and commissions

Buy heifers, medium 1, 965# @ $103.77

Apr 11 @ $102.10

COG @ $0.80

Weight out: 1350#

Breakeven: $96.69

Profit: $68.96/head less basis and commissions

Thank you and Have a Great Day!!

Tuesday, August 31, 2010

Opportunities to Background Calves This Fall?

This could be a good year to think about backgrounding calves, especially with the cash and futures we have seen this summer. Although I think the current spike we are seeing will fade within the next couple of weeks, I think there are some really amazing opportuntiies to add value to this years' calf crop.

There are however, two key factors to consider:

1) Using price protection is a must

2) COG must be kept to an absolute minimum

Last week I talked about how the value was in the market positions and not so much in the cattle themselves. But when the calves you are feeding are out of your herd, the value is in the cattle themselves and not so much in the market positions. In this situation, the position in the market is purely protection with little to be gained on the turnaround.

Earlier this summer I wrote a piece on how the cash market was not valuing the feed that was being put into calves in the eastern part of the state. As a rule that is still true, however, the futures market is valuing that feed very nicely at this point in time. The problem is that the cash market right now also is valuing that feed, which may lead some to believe that price protection is not necessary. I respectfully disagree as I expect that will change as we move into the weaned calf run later this fall. Therefore, price protection on backgrounded calves is going to be critical to retain that value.

At this point, I think an LRP is the best option for the average rancher that doesn't regularly use market protection tools. An LRP works basically like crop insurance and functions basically the same as an Option Put without the need to buy back an opposite position in the market. With an LRP, you can protect the bottom side and let the top ride. If cash prices at market time are higher than the value of the LRP, you are simply lose out on the premium cost of the insurance, which is really peanuts in the grand scheme of things.

Short hedging and Options Puts are still great tools for those that are familiar with how they work, but for the average Joe Rancher who doesn't want to mess with buy backs or margin calls, I think LRP's will work nicely for them.

Let's look at some examples:

I'm going to use a group of 600# East River weaned calves as an example.

Calf breakeven off the cow: $550/head or $0.92/lb

If these calves are marketed off the cow November 1 at $117.00, gross revenue will be $702.00/hd less commission.

Net return on these calves will be $152/hd

Now let's say these calves are short hedged on the JAN 11 and backgrounded for 75 days:

Weight in: 600#

Short hedged at $115.67

ADG: 2.5#/day

COG: $0.65/lb

Weight out: 790#

Breakeven: $85.57

Net return: $237.02/hd less basis and commissions

So the value of backgrounding these calves was $85/hd which was about 36% more than if they were sold right off the cow.

Now let's look at a group of 600# West River weaned calves as an example.

Calf breakeven off the cow: $475/head or $0.79/lb

If these calves are marketed off the cow November 1 at $117.00, gross revenue will be $702.00/hd less commission.

Net return on these calves will be $227/hd

Now let's say these calves are short hedged on the JAN 11 and backgrounded for 75 days:

Weight in: 600#

Short hedged at $115.67

ADG: 1.5#/day

COG: $0.40/lb

Weight out: 712#

Breakeven: $72.84

Net return: $305.14/hd less basis and commissions

Don't be fooled by the larger net return on these West River calves, most of the higher net return was realized by slightly cheaper cow cost before the calf was weaned. The actual value of backgrounding these calves was $78.14/hd. This is still a very nice return on the gain and is 25.6% higher than if these calves were sold off the cow.

I used a short hedge for ease of calculation, an Option Put or an LRP will provide similar protection with some variation in implementation and payout.

The bottomline here for ranchers is that I think there is some money to be made this year with a backgrounding program, but protecting your bottom side will be the key to turning this value into cash in your pocket.

Thanks for stopping by and have a great day!!

There are however, two key factors to consider:

1) Using price protection is a must

2) COG must be kept to an absolute minimum

Last week I talked about how the value was in the market positions and not so much in the cattle themselves. But when the calves you are feeding are out of your herd, the value is in the cattle themselves and not so much in the market positions. In this situation, the position in the market is purely protection with little to be gained on the turnaround.

Earlier this summer I wrote a piece on how the cash market was not valuing the feed that was being put into calves in the eastern part of the state. As a rule that is still true, however, the futures market is valuing that feed very nicely at this point in time. The problem is that the cash market right now also is valuing that feed, which may lead some to believe that price protection is not necessary. I respectfully disagree as I expect that will change as we move into the weaned calf run later this fall. Therefore, price protection on backgrounded calves is going to be critical to retain that value.

At this point, I think an LRP is the best option for the average rancher that doesn't regularly use market protection tools. An LRP works basically like crop insurance and functions basically the same as an Option Put without the need to buy back an opposite position in the market. With an LRP, you can protect the bottom side and let the top ride. If cash prices at market time are higher than the value of the LRP, you are simply lose out on the premium cost of the insurance, which is really peanuts in the grand scheme of things.

Short hedging and Options Puts are still great tools for those that are familiar with how they work, but for the average Joe Rancher who doesn't want to mess with buy backs or margin calls, I think LRP's will work nicely for them.

Let's look at some examples:

I'm going to use a group of 600# East River weaned calves as an example.

Calf breakeven off the cow: $550/head or $0.92/lb

If these calves are marketed off the cow November 1 at $117.00, gross revenue will be $702.00/hd less commission.

Net return on these calves will be $152/hd

Now let's say these calves are short hedged on the JAN 11 and backgrounded for 75 days:

Weight in: 600#

Short hedged at $115.67

ADG: 2.5#/day

COG: $0.65/lb

Weight out: 790#

Breakeven: $85.57

Net return: $237.02/hd less basis and commissions

So the value of backgrounding these calves was $85/hd which was about 36% more than if they were sold right off the cow.

Now let's look at a group of 600# West River weaned calves as an example.

Calf breakeven off the cow: $475/head or $0.79/lb

If these calves are marketed off the cow November 1 at $117.00, gross revenue will be $702.00/hd less commission.

Net return on these calves will be $227/hd

Now let's say these calves are short hedged on the JAN 11 and backgrounded for 75 days:

Weight in: 600#

Short hedged at $115.67

ADG: 1.5#/day

COG: $0.40/lb

Weight out: 712#

Breakeven: $72.84

Net return: $305.14/hd less basis and commissions

Don't be fooled by the larger net return on these West River calves, most of the higher net return was realized by slightly cheaper cow cost before the calf was weaned. The actual value of backgrounding these calves was $78.14/hd. This is still a very nice return on the gain and is 25.6% higher than if these calves were sold off the cow.

I used a short hedge for ease of calculation, an Option Put or an LRP will provide similar protection with some variation in implementation and payout.

The bottomline here for ranchers is that I think there is some money to be made this year with a backgrounding program, but protecting your bottom side will be the key to turning this value into cash in your pocket.

Thanks for stopping by and have a great day!!

Wednesday, August 25, 2010

This Week In Cattle

The big fall run on cattle coming off grass is currently underway. There are some crazy things happening in both the cash and futures markets that are creating a perfect storm for guys that are willing to jockey for positions in the futures market to protect their investments.

I'm not really going to speculate much on the reasons that this cattle market has gone out of it's mind because I really don't know why and furthermore it doesn't really matter. There are two things that I think matter right now, 1) This market is very volatile and is not really supported by fundamentals so it could tank as fast as it took off and 2) There have been millionaires made in the last week so look for the cash market to respond next week.

What does that mean? For #1, the money right now is in the futures positions, not in the cattle themselves so if you get into any cattle, short hedge them now!! Better yet, with the volatility in the market, option puts or Livestock Risk Protection (LRP) might be a good choice to protect the bottom side and let the top side ride. Avoiding margin calls could be the name of this game for awhile.

For #2, if you have cattle that are finishing up on grass, get them to town. I don't forsee this market insanity lasting much past mid-September so you've got a couple weeks to market unprotected calves. This is pretty much what we saw happen last year at this time during the grass cattle run.

If you have your grass cattle locked in on a SEP 10 contract, don't get jittery and dump your position thinking it may go higher. It may go higher, but not much so you aren't going to gain much since you've already paid the margin calls.

I had a marketing professor when I was in college tell me that "bears make money and bulls make money, but hogs always get slaughtered". Hold your position and market cattle as planned, you locked in a profit in May and the profit is still there.

It appears as though there is some real potential in some quick turns on backgrounding some of these calves coming off grass for 60-75 days this fall. The key will be cheap cost of gain. I think this type of program will build some flexibility into your system because come January you may decide to dump your position on some of your contracts in the feeders market and get back in on the fat market and go ahead and finish them out. You'll have to pencil it for yourself, but I think that possibility exists.

Let's look at some examples:

Buy steers medium 1, 668# off grass @ $127.00

Lock 'em in the JAN 11 @ $116.60

Feed for 75 days with a COG of $0.70

Weight out: 855#

Breakeven: $114.50

Profit: $17.90/head less basis and commissions

Buy steers medium 1, 777# off grass @ $120.18

Lock 'em in the JAN 11 @ $116.60

Feed for 75 days with a COG of $0.70

Weight out: 964#

Breakeven: $110.42

Profit: $59.55/head less basis and commissions

Buy steers medium 1, 870# off grass @ $116.36

Lock 'em in the JAN 11 @ $116.60

Feed for 75 days with a COG of $0.70

Weight out: 1057#

Breakeven: $108.14

Profit: $89.46/head less basis and commissions

Buy heifers medium 1, 695# off grass @ $117.86

Lock 'em in the JAN 11 @ $116.60

Feed for 75 days with a COG of $0.70

Weight out: 867#

Breakeven: $108.34

Profit: $71.62/head less basis and commissions

Buy heifers medium 1, 780# off grass @ $115.28

Lock 'em in the JAN 11 @ $116.60

Feed for 75 days with a COG of $0.70

Weight out: 937#

Breakeven: $107.67

Profit: $83.69/head less basis and commissions

Buy heifers medium 1, 874# off grass @ $110.24

Lock 'em in the JAN 11 @ $116.60

Feed for 75 days with a COG of $0.70

Weight out: 1016#

Breakeven: $104.45

Profit: $121.99/head less basis and commissions

I would probably stay away from the light steers as demand for them is driving the price through the roof as has been the case all summer. The medium and heavies are probably the best bet right now with heifers returning a little better than steers. These breakevens are calculated on a sliding 2.5#/day ADG so I would leave them un-implanted and keep your COG to $0.70/lb or less if you can. I think selling un-implanted 10 wts. in January will keep you near the top of the market when you take them to town. It shouldn't be too much trouble to reach that COG goal with a little management. If you decide to finish some of them out, stick an implant in them and go.

Thanks for stopping by and have a great day!!

I'm not really going to speculate much on the reasons that this cattle market has gone out of it's mind because I really don't know why and furthermore it doesn't really matter. There are two things that I think matter right now, 1) This market is very volatile and is not really supported by fundamentals so it could tank as fast as it took off and 2) There have been millionaires made in the last week so look for the cash market to respond next week.

What does that mean? For #1, the money right now is in the futures positions, not in the cattle themselves so if you get into any cattle, short hedge them now!! Better yet, with the volatility in the market, option puts or Livestock Risk Protection (LRP) might be a good choice to protect the bottom side and let the top side ride. Avoiding margin calls could be the name of this game for awhile.

For #2, if you have cattle that are finishing up on grass, get them to town. I don't forsee this market insanity lasting much past mid-September so you've got a couple weeks to market unprotected calves. This is pretty much what we saw happen last year at this time during the grass cattle run.

If you have your grass cattle locked in on a SEP 10 contract, don't get jittery and dump your position thinking it may go higher. It may go higher, but not much so you aren't going to gain much since you've already paid the margin calls.

I had a marketing professor when I was in college tell me that "bears make money and bulls make money, but hogs always get slaughtered". Hold your position and market cattle as planned, you locked in a profit in May and the profit is still there.

It appears as though there is some real potential in some quick turns on backgrounding some of these calves coming off grass for 60-75 days this fall. The key will be cheap cost of gain. I think this type of program will build some flexibility into your system because come January you may decide to dump your position on some of your contracts in the feeders market and get back in on the fat market and go ahead and finish them out. You'll have to pencil it for yourself, but I think that possibility exists.

Let's look at some examples:

Buy steers medium 1, 668# off grass @ $127.00

Lock 'em in the JAN 11 @ $116.60

Feed for 75 days with a COG of $0.70

Weight out: 855#

Breakeven: $114.50

Profit: $17.90/head less basis and commissions

Buy steers medium 1, 777# off grass @ $120.18

Lock 'em in the JAN 11 @ $116.60

Feed for 75 days with a COG of $0.70

Weight out: 964#

Breakeven: $110.42

Profit: $59.55/head less basis and commissions

Buy steers medium 1, 870# off grass @ $116.36

Lock 'em in the JAN 11 @ $116.60

Feed for 75 days with a COG of $0.70

Weight out: 1057#

Breakeven: $108.14

Profit: $89.46/head less basis and commissions

Buy heifers medium 1, 695# off grass @ $117.86

Lock 'em in the JAN 11 @ $116.60

Feed for 75 days with a COG of $0.70

Weight out: 867#

Breakeven: $108.34

Profit: $71.62/head less basis and commissions

Buy heifers medium 1, 780# off grass @ $115.28

Lock 'em in the JAN 11 @ $116.60

Feed for 75 days with a COG of $0.70

Weight out: 937#

Breakeven: $107.67

Profit: $83.69/head less basis and commissions

Buy heifers medium 1, 874# off grass @ $110.24

Lock 'em in the JAN 11 @ $116.60

Feed for 75 days with a COG of $0.70

Weight out: 1016#

Breakeven: $104.45

Profit: $121.99/head less basis and commissions

I would probably stay away from the light steers as demand for them is driving the price through the roof as has been the case all summer. The medium and heavies are probably the best bet right now with heifers returning a little better than steers. These breakevens are calculated on a sliding 2.5#/day ADG so I would leave them un-implanted and keep your COG to $0.70/lb or less if you can. I think selling un-implanted 10 wts. in January will keep you near the top of the market when you take them to town. It shouldn't be too much trouble to reach that COG goal with a little management. If you decide to finish some of them out, stick an implant in them and go.

Thanks for stopping by and have a great day!!

Friday, August 6, 2010

CREA Argentina

Every year, I take a group of students from SDSU down to Argentina so they can gets some international agriculture exposure before they graduate and go into the workforce. Most employers in corporate ag industry these days really frown upon students that went through four years of college and never received any international training. I'm sure this is a reflection of our global aconomic environment more than anything, but it is interesting none-the-less.

In any event, over the years, I have been fortunate enough to develop some really good relationships with ranchers, farmers, cattle feeders, etc. in Argentina. As a result of these relationships, they asked me last year if I would put together a feedlot tour of South Dakota for them if they came to the US. Of course I said I would and sure enough, Monday and Tuesday this week I hosted 22 ranchers from the province of LaPampa on a tour of SD feedlots.

Now you might ask yourself, why do a bunch of guys from LaPampa, the grass cattle capital of the world want to look at feedlots? Well, the days of endless hectares of grass and millions of grass fed cattle in the Pampas are quickly drawing to a close thanks to our friends at Monsanto, DuPont, etc. With drought resistant and RR crops, most of the eastern Pampas is being plowed under and planted to soybeans. Cattle, even in Argentina can simply not compete with soy.

As a result, much like in the US in the 60's, the Argentine beef industry is reluctantly facing the fact that cattle are going to have to be finished on corn in feedlots if they want to eat beef. Otherwise, beef cattle will simply disappear in a sea of soybeans and government incentives.

Only about 4% of cattle in the country are currently finished on corn, but when I started going to Argetnina it was about 0.05% and in the next year or so it will probably be around 8%. So the number is roughly doubling every year.

The CREA group that visited this last week is a group of the most progressive producers in the country and they want to lead the charge into developing a cattle feeding industry. CREA is an acronym for Regional Consortium of Agricultural Experimentation. This group works collectively to help each other learn how to improve their operations through information sharing between families and ultimately through other CREA groups in the country.

Over the next few days I'll tell you a little about what we did on the tour and what the reaction of the group was to their visit in South Dakota, but for now I'll just tell you they had a wonderful time, were very impressed with the people they met here in SD, and went home hoping some of their US counterparts would be willing to come visit thier operations in Argentina.

I think we can probably arrange that.

Thank you and have a great day!!

In any event, over the years, I have been fortunate enough to develop some really good relationships with ranchers, farmers, cattle feeders, etc. in Argentina. As a result of these relationships, they asked me last year if I would put together a feedlot tour of South Dakota for them if they came to the US. Of course I said I would and sure enough, Monday and Tuesday this week I hosted 22 ranchers from the province of LaPampa on a tour of SD feedlots.

Now you might ask yourself, why do a bunch of guys from LaPampa, the grass cattle capital of the world want to look at feedlots? Well, the days of endless hectares of grass and millions of grass fed cattle in the Pampas are quickly drawing to a close thanks to our friends at Monsanto, DuPont, etc. With drought resistant and RR crops, most of the eastern Pampas is being plowed under and planted to soybeans. Cattle, even in Argentina can simply not compete with soy.

As a result, much like in the US in the 60's, the Argentine beef industry is reluctantly facing the fact that cattle are going to have to be finished on corn in feedlots if they want to eat beef. Otherwise, beef cattle will simply disappear in a sea of soybeans and government incentives.

Only about 4% of cattle in the country are currently finished on corn, but when I started going to Argetnina it was about 0.05% and in the next year or so it will probably be around 8%. So the number is roughly doubling every year.

The CREA group that visited this last week is a group of the most progressive producers in the country and they want to lead the charge into developing a cattle feeding industry. CREA is an acronym for Regional Consortium of Agricultural Experimentation. This group works collectively to help each other learn how to improve their operations through information sharing between families and ultimately through other CREA groups in the country.

Over the next few days I'll tell you a little about what we did on the tour and what the reaction of the group was to their visit in South Dakota, but for now I'll just tell you they had a wonderful time, were very impressed with the people they met here in SD, and went home hoping some of their US counterparts would be willing to come visit thier operations in Argentina.

I think we can probably arrange that.

Thank you and have a great day!!

Wednesday, July 28, 2010

Cow Size Efficiency

As the optimum cow size debate rages on, I have become interested in whether cow size really makes that much difference from an economic perspective. Common sense and general knowledge of biology would suggest that you don't need to have a PhD to figure out that a smaller cow should eat less than a larger cow and therefore should have a lower annual feed cost. I don't think there is really much debate on this point either amongst academia or industry.

Similarly, but less obvious, is the question of whether a larger cow will produce more pounds of weaned calf than a smaller cow. There are a few research papers out there that show it both ways. In some reports, smaller cows produced less total pounds of weaned calf than larger cows and in other reports they weaned about the same number of pounds.

Unfortunately, many of these reports don't address the economic side of the issue. They simply report comparative weaning weights vs. cow size and proclaim that one is more profitable than the other (whether one is really more profitable can't really be determined from the data presented).

And finally, the question that many have attempted to answer subjectively is whether cow size affects overall profitability and if it does, by how much? So the questions becomes not so much whether small cow A produces more or less pounds than larger cow B, but rather does smaller cow A convert dollars of feed fed into pounds of weaned calf more efficiently than larger cow B.

Inevitably, I got tired of wondering about this so I began amassing a data set of cow weights and weaning weights. I have pulled data from reported literature, producers around the state, and at the SDSU Cow Camp Experiment Station. All-in-all I have about 1,750 pairs in the data set.

So let's look at the first question, Do larger cows wean more pounds of calf than smaller cows?

To look at this, what I did was take the data set and sort by cow weight and then grouped into the lightest 25%, the second lightest 25%, the heaviest 25% and the second heaviest 25%. So out of 1,685 pairs in this set, there are approximately 420 pairs in each weight class. I then the average cow weight in each weight class and divided it by the average weaning weight for that same class, giving a weight production ratio.

Most academians don't like these weight ratios, and I tend to agree with them. The problem is that when you look at these weight ratios, you tend to make all kinds of assumptions about them with no real data to confirm or deny. So, when you look at a cow weight to weaning weight ratio, it is just that, a ratio of weight produced by weight maintained.

The first table shows that as cow weight increased, calf weaning weight also increased. So it seems that larger cows do tend to produce slightly larger calves on average. There is 114 lb. difference between the weaning weights of the lightest and heaviest groups of cows.

What is interesting though is to look at the ratio of cow weight to weaning weight. This ratio does not tell us anything about efficiency per se, but it does indicate that weaning weight does not necessarily increase at the same rate as cow size.

If you look at data from the SDSU Cow Camp you see the same trend:

The actual weaning weights did not increase as linearly as cows got larger as they did in the other data set, but the weight ratio shows approximately the same trend.

Well, that's fine if larger cows produce slightly larger calves on average, but does it really make that much of a difference to the bottom line of a cow outfit.

What I did to test this was to model the economic inputs and outputs of these pairs based on weight class

This model shows that in fact it does make quite a bit of economic difference between the smaller and larger cows as the smallest cows returned 50% more on a per head basis than did the largest cows even though the smaller cows weaned 19% less weight.

The principle reasons for this is that smaller cows eat less and therefore have a lower annual feed cost. It's that simple. The larger cows weaned more pounds and grossed more on a per head basis, but the cost differentiation of getting there compared to a smaller cow with a lighter calf was larger. Therefore, the efficiency of feed fed to production was greater for the smaller cows.

We see the same pattern in the cow herd out at the SDSU Cow Camp.

The big thing here to understand is that from this data we cannot say that Rancher A has smaller cows than rancher B therefore rancher A must be more profitable.

This is simply a misnomer that has no factual basis. In fact, this is so dependent on feed cost, that rancher B, with bigger cows could easily be more profitable than rancher A with smaller cows, simply because rancher B can produce cheaper feed.

What we can say about this data set is that if rancher A currently has 1500 lb. cows and works towards a more moderate cow size through breeding and culling management, rancher A can improve profitability pretty dramatically.

Let's look at a model of this concept:

This model illustrates that if we fix land area and stocking rate, all other things equal, as would be the case with an individual cow outfit that changes cow size, how profitability changes.

In this model I fixed land area at 5,000 acres with a fixed stocking rate of 0.75 AUM's/acre.

By changing from a cow size of 1541lbs. to an average cow size of about 1000 lbs., profitability increases by about 68%. The big difference here is that on a fixed amount of land, you can run 36% more 1000 lb. cows at the same fixed stocking rate than you can 1541 lb. cows.

Again, you see the same pattern using the data collected from the SDSU Cow Camp:

Here, we are running on less acres and a higher stocking rate, but it is fixed across all weight groups.

What is really striking is that the difference in profitability between the largest group and the smallest group is about the same as the other, totally unrelated data set at 68%!!

I was very surprised by the results of this, as I stated earlier, I figured that small cows ate less than large cows and large cows wean more weight, but I never realized there was such a large efficiency difference.

Monday, July 19, 2010

This Week in Cattle

There are some incredible values in the market place right now in both the cash steer and heifer markets for guys that are willing to protect their investment on a relatively static futures market.

As usual, there is pretty strong demand for 6 and low 7 weight steers that has slightly over valued cattle in this weight class.

However, heavier steers and heifers are pretty reasonably valued right now, especially for those that can put on some relatively cheap gain (<$0.70/lb.) in a backgrounding yard.

Examples:

Buy steers, medium 1, 693# @ $124.21

Lock NOV '10 at $113.90

Grass 60 days @ $0.72/day

Background 60 days @ $0.70/lb. cost of gain.

Sell: 921#

Breakeven: $111.72

Profit: $20.05/head less basis and commissions

Buy steers, medium 1, 792# @ $115.00

Lock NOV '10 at $113.90

Grass 60 days @ $0.72/day

Background 60 days @ $0.70/lb. cost of gain.

Sell: 996#

Breakeven: $107.48

Profit: $63.92/head less basis and commissions

Buy steers, medium 1, 819# @ $113.84

Lock NOV '10 at $113.90

Grass 60 days @ $0.72/day

Background 60 days @ $0.70/lb. cost of gain.

Sell: 999#

Breakeven: $108.47

Profit: $54.17/head less basis and commissions

Buy heifers, medium 1, 724# @ $114.55

Lock NOV '10 at $113.90

Grass 60 days @ $0.72/day

Background 60 days @ $0.70/lb. cost fo gain.

Sell: 928#

Breakeven: $106.58

Profit: $67.85/head less basis and commissions

Buy heifers, medium 1, 839# @ $106.05

Lock NOV '10 at $113.90

Grass 60 days @ $0.72/day

Background 60 days @ $0.70/lb. cost fo gain.

Sell: 1019#

Breakeven: $102.17

Profit: $119.52/head less basis and commissions

Buy heifers, medium 1, 896# @ $99.40

Lock NOV '10 at $113.90

Grass 60 days @ $0.72/day

Background 60 days @ $0.70/lb. cost fo gain.

Sell: 1052#